How to win in mobile gaming with data-driven insights

Prashansa Shrestha, Content Writer, Adjust, Apr 30, 2024.

As the mobile gaming industry continues to evolve rapidly, it presents both challenges and opportunities for app marketers and developers—from navigating complex privacy regulations and harnessing the power of generative AI to developing next-gen tech and measurement stacks. For scalable growth and success in this increasingly competitive market, it’s crucial to produce high-quality creatives, find the right channels, and effectively utilize connected TV (CTV) advertising. Moreover, crafting the right marketing mix, diversifying segments and revenue streams, and tailoring marketing efforts to players’ preferences and behavior can make the difference between growth and stagnation.

The gaming app insights report: Unlocking growth opportunities for mobile marketers offers an in-depth analysis of these areas. Leveraging Adjust data and expert insights from AppLovin and SparkLabz, this report provides you with strategies to master mobile gaming marketing in 2024 and beyond.

Ready to level up your game? Download the full report or continue reading here for a sneak peek at the trends, best-performing regions, and top gaming app categories.

Mobile gaming in 2024 and beyond: A look at potential growth areas

2023 was a year full of surprises for the mobile gaming industry. Despite a decade of continuous growth, gaming installs decreased by 2%, and sessions fell by 7%. However, the industry proved resilient, beginning a bounce back in Q4 2023 as installs increased by 7% YoY. This positive growth continued into the new year, with January 2024 sessions growing by 3% YoY.

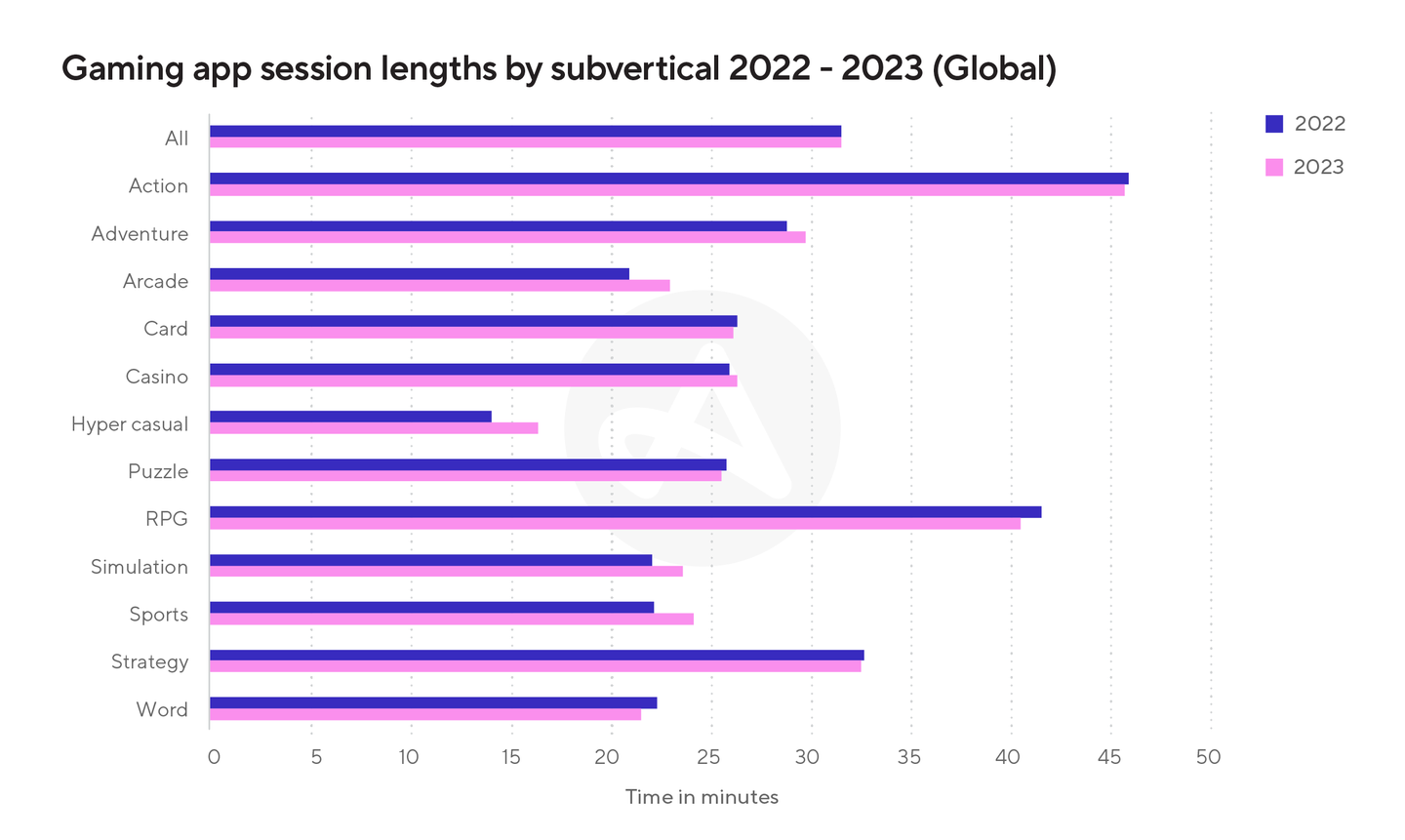

Throughout the fluctuations in 2023, mobile gamers stayed loyal to their quests, spending an average of 31.5 minutes per session across all genres. As always, certain gaming subverticals emerged with the longest sessions. Action games had the highest numbers, albeit with a slight decrease from 45.8 to 45.7 minutes. Adventure games, on the other hand, saw an increase from 28.8 to 29.7 minutes. Hyper casual games made the biggest leap, from 14 to 16.4 minutes, while RPGs experienced a slight decrease, dropping from 41.5 to 40.4 minutes.

When analyzing session lengths regionally, APAC led in 2023 with an average of 35 minutes per session, followed by EMEA (29 minutes), LATAM (27 minutes), and North America (25 minutes). At country level, Indonesia topped the list with an impressive average of 48 minutes, with the Philippines close behind at 46 minutes. The UK and Ireland, however, had the shortest session lengths at 24 minutes.

These regional variations highlight the diverse gamer preferences and behavior around the world. APAC gamers prefer action and RPG titles, while UK and Irish gamers lean towards lighter hyper casual, and arcade games. That’s why it's crucial to personalize user experiences and utilize AI to tailor gaming experiences to player preferences to enable increased session lengths and earlier monetization.

A deep dive into gaming app retention trends

Let’s take a closer look at the engagement levels of players in mobile games by analyzing retention rates. In 2023, the global median day 1 retention rate for gaming apps decreased slightly from 29% in 2022 to 28.3%. Despite this minor decrease overall, specific gaming subverticals performed impressively. For instance, hybrid casual games outperformed the global median with a retention rate of 29%, two percentage points higher than hyper casual games. Sports apps sprinted to the top with the highest rate of 31%, closely followed by casino, puzzle, RPG, and simulation games, each with 30%.

Regionally, APAC surpassed the global median with a day 1 retention rate of 29%. Within APAC, both Indonesia and India matched this rate, while Japan and Singapore followed closely at 28%. EMEA, LATAM, and Mexico also recorded a day 1 retention rate of 28%. On the other hand, South Korea, the UAE, and Brazil had lower retention rates at 25%.

To improve these retention figures, mobile app marketers and developers can adopt numerous strategies, such as optimizing onboarding, tailoring content to regional preferences, and gamifying user experiences to maintain player interest. It’s also important, however, to remember that different genres come with differing user patterns and expectations, meaning there’s no one size fits all retention rate for mobile games.

The economics of mobile gaming

Despite a less than impressive growth in installs and sessions for mobile gaming in 2023, in-app revenue for gaming apps increased by a significant 6% YoY. This revenue peaked in December, rising 17% above the yearly average and 21% YoY, coinciding with a spike in installs in the fourth quarter. January already showed a promising start with a 13% YoY rise in revenue, a trend we expect to see continue.

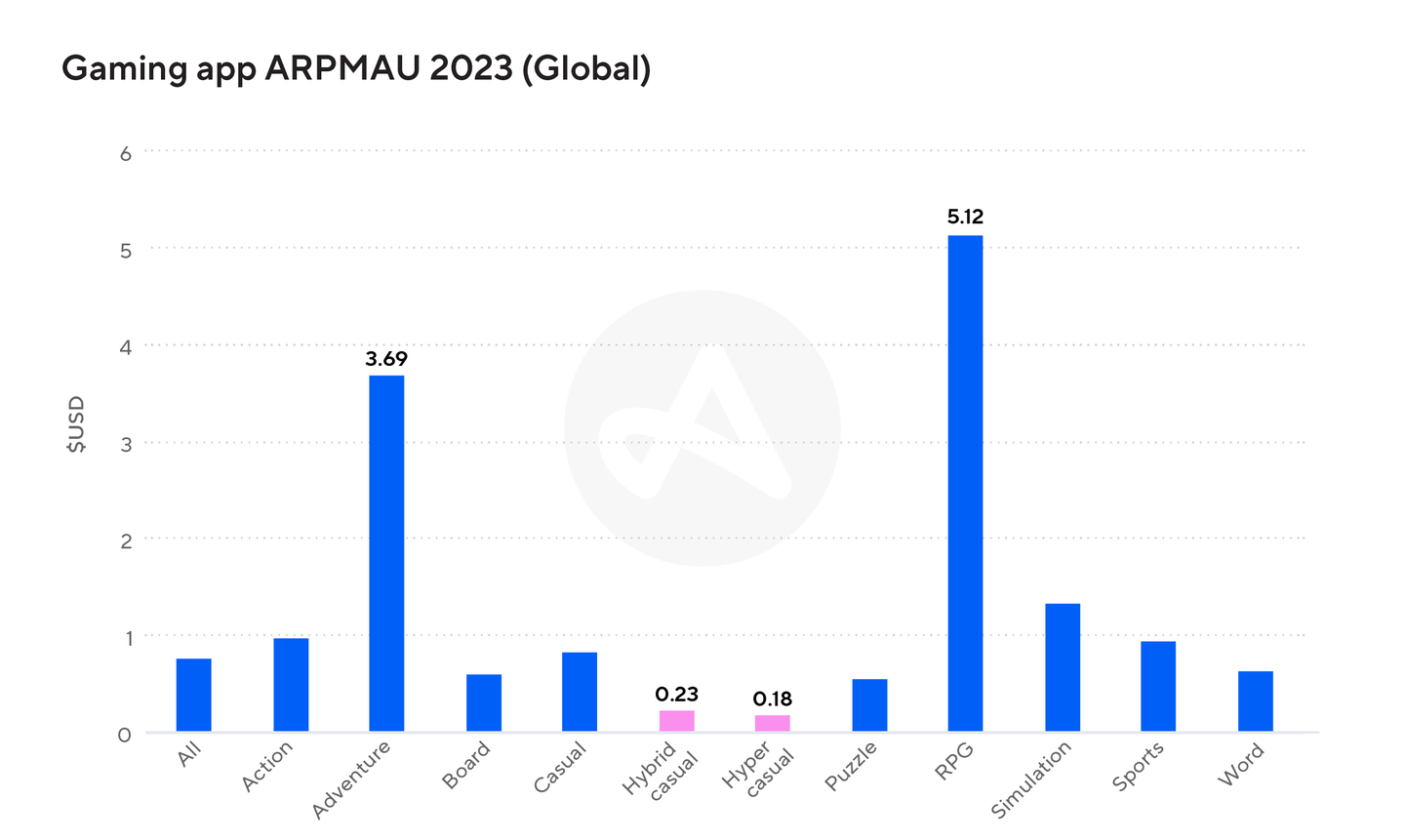

This report also analyzes the average revenue per monthly active user (ARPMAU), a key indicator of monetization efficiency and user engagement. In 2023, the ARPMAU across all mobile gaming subcategories was $0.77. Specifically, RPGs generated the highest ARPMAU at $5.12, while adventure games earned $3.69 per MAU.

On the flip side, hyper casual games, known for their high user turnover but low monetization from in-app purchases (IAPs), recorded the lowest ARPMAU at $0.18. This is slightly lower than hybrid casual games, which earned $0.23 per MAU, marking a substantial 39% increase.

Regionally, the U.S. had the highest ARPMAU at $1.25, which is 62% above the global average. Japan followed at $1.03, while the APAC region had a median of $0.55. This variation was due to lower ARPMAUs in countries like India and the Philippines, which reported $0.07 and $0.14, respectively. EMEA showed moderate figures, with German-speaking countries (DACH) recording the highest regional ARPMAU at $0.60. LATAM, including Brazil and Mexico, had the lowest ARPMAUs, all below $0.20.

For mobile marketers and app developers aiming to boost ARPMAU and maintain a financially stable gaming app within the hyper-competitive ecosystem, it's vital to focus on effective monetization strategies. These include tailoring monetization methods to user preferences and behavior in different regions, localizing content, diversifying revenue streams by exploring subscriptions and partnerships beyond traditional ads, and using data analytics for targeted monetization.

To learn more about the growth opportunities in the mobile gaming space and how you can take advantage of them to scale your app this year, secure your copy of The gaming app insights report: Unlocking growth opportunities for mobile marketers today.

Be the first to know. Subscribe for monthly app insights.