Gaming apps mid-2023: The status quo + 4 tips to rally

Micah Motta, Senior Content Writer, Adjust, Jun 21, 2023.

It’s well-known 2022 was a rough year for gaming apps, but now that we’re halfway into 2023, how are they doing? Below we have the skinny on the current state of mobile gaming apps in 2023, covering everything from installs to retention. But fear not, while there have been a few dips here and there, mobile gaming apps have tools at their disposal to make a complete comeback by the end of 2023.

Install growth is playing with our hearts

Gaming app installs—will they come back to full strength or won’t they? Resembling a heart monitor, gaming app install growth has had its ups and downs recently, but is overall active and alive. Compared to Q4 2022, Q1 2023 gaming apps saw a hopeful 7% increase in installs. And despite lower numbers year-over-year, April and May are continuing the upward trend in 2023 so far, at 2% higher than Q1 and 9% above Q4. If this positive upswing continues, H2 is looking promising for the gaming vertical.

Tip 1: Expand into new advertising channels

Amidst the economic downturn, many marketing teams are pulling back on ad spend. They’re also sticking to the channels and metrics they know. However, we encourage marketers to test out new channels—including connected TV (CTV), uncover where their users with the highest lifetime (LTV) are coming from, and drill down into which creatives are performing best.

Example: Widogame expands channels to grow installs by 4,900%

Mobile game publisher Widogame went from one to 10 advertising channels and began to daily monitor a long list of measurable touchpoints with Adjust. By discovering the right channels, Widogame grew its revenue by 2,200% and installs by 4,900%. Read the Widogame case study now.

Gaming sessions: Are they on the up and up?

In line with the overall trend for mobile gaming apps in 2022, sessions struggled. In better news, mobile gaming app users appear to be rallying around their favorite titles again in 2023! As reported in the Adjust Mobile app trends: 2023 edition, January’s gaming sessions were already 11% higher than the average of Q4 2022. Fast-forward to the latest data and, encouragingly, Q1 2023 ended up rounding out at 9% higher than the previous quarter, with April the highest point so far—up around 12% compared to 2022’s low point in September.

Tip 2: Add a social feature

It’s never too late to add a social feature to your gaming app. It could be a competitive leaderboard that encourages users to check their ranking multiple times a day. Or, social currency is another feature that allows users to earn special in-app currency by attending events in your app and interacting with other users. Consider incorporating an activity feed through which users can check in on other users’ progress, share lives and in-app currency, and more.

Lastly, some apps, like Pokémon GO, famous for its community-centric gameplay including monthly events and major annual festivals, are jam-packed with features encouraging player interaction. From five star raid battles that can only be completed with more than five players to its player-vs-player (PVP) option, the game features a lot of elements that encourage a high number of sessions per day.

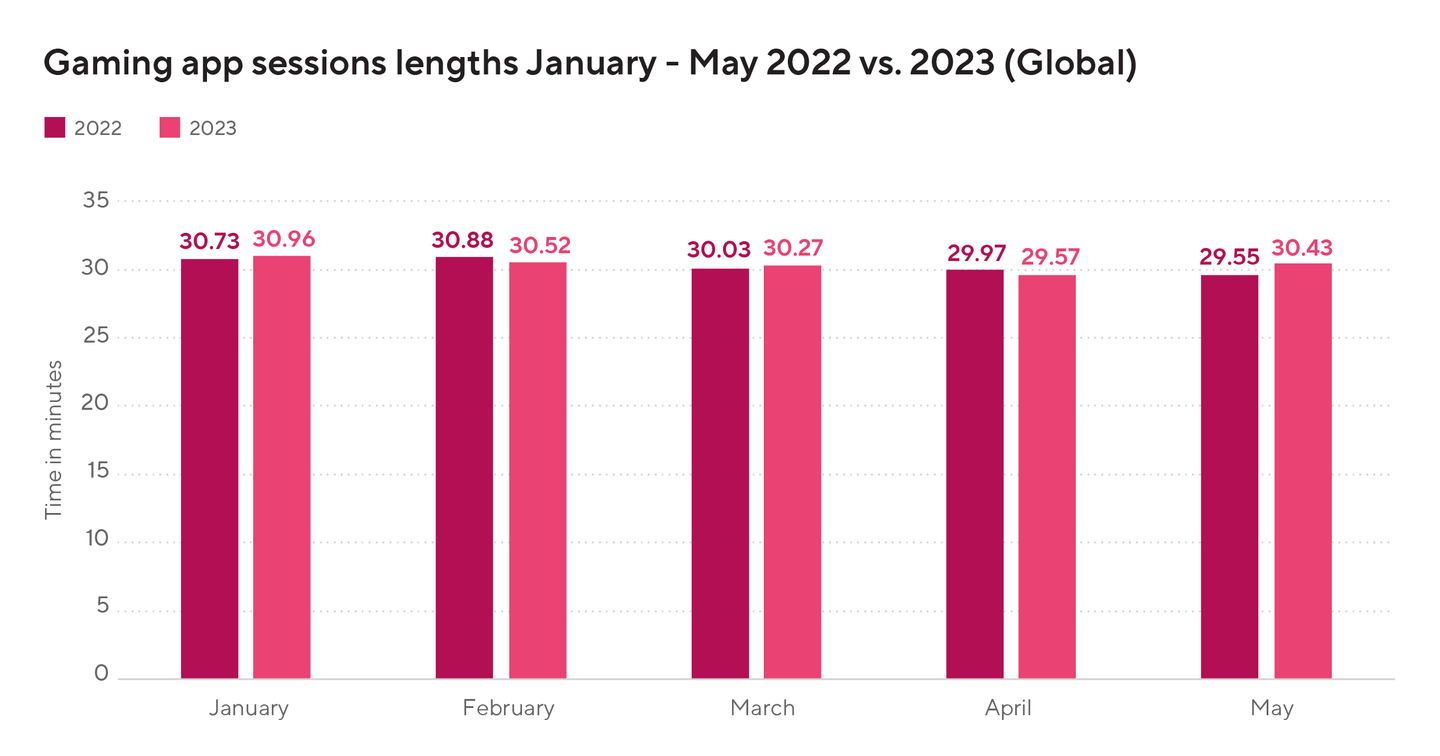

Thus far, session lengths are sending positive signals

Gaming session lengths have been fairly close in length to the previous year when comparing the months of January through May YoY. But even so, January, March, and May were slightly above their 2022 session lengths at 30.96 minutes, 30.27 minutes, and 30.43 minutes, respectively. Notably, May’s gaming app session lengths enjoyed a 3% increase from May 2022. Even a small increase in session lengths can do wonders for monetization and opportunities to drive up a user’s LTV.

Tip 3: Further gamify your app

Yes, believe it or not, even gaming apps’ user engagement can benefit from adding additional gamification elements to their apps. Borrowing mechanics from another gaming category’s playbook is a great way to start. Let’s say you have an adventure app, and at every level of this app users earn a certain amount of coins that they can trade for free lives or skipping levels. Why not send users an in-app message offering them double coins if they’re able to reach the next level? You can mark the offer as “limited time” or “today only” for urgency.

But, this is only one of the many ways you can amplify the opportunities to keep users in your gaming app with gamification. Get six gamification strategies in our guide Play to win: Using gamification to give your app an unbeatable edge.

Retention rates take a slight dip in 2023 so far

Retention rates for mobile gaming apps so far into 2023 have slipped somewhat YoY, with Day 1, Day 7, Day 14, and Day 28 all lower by one percentage point than 2022, at 28%, 13%, 9%, and 6%, respectively. Day 30 retention rate remains consistent with that of 2022 at 6%.

For a deep dive into retention strategies, check out our retention guide.

Tip 4: Consider developing a hybrid casual game

The emerging games category: Hybrid casual games, which combines two different gaming genres, offers increased opportunities for monetization and retention As the name suggests, this genre combo serves hybrid casual games by offering the accessibility of a hyper casual game with casual and mid-core game elements like collection systems or leaderboards that keep users loyal to the game. Therefore, revamping an existing hyper casual app to create a hybrid casual game—or developing one—could serve to vastly improve your retention rates and monetization opportunities.

Angry Birds 2 is a good example of a hybrid casual game as users can immediately understand how to play it and enjoy coming back to compete in new events.

Want to make sure your gaming app sees major growth this year? With campaign automation, smart alerts, and accurate mobile attribution, Adjust’s mobile analytics and measurement suite can help your marketing team do more with less. To see Adjust in action (see what we did there), schedule your demo now.

Be the first to know. Subscribe for monthly app insights.