GUIDE

The complete guide to CTV advertising and marketing

Introduction

The landscape of television has changed dramatically over the last fifteen years. No longer are viewers dependent on a strict program schedule, but they can choose from a seemingly unlimited digital cornucopia of shows on demand. As more of mobile advertisers’ desired users stream movies from TVs or phones connected to the internet, it’s imperative they understand the connected TV (CTV) ecosystem. In doing so, they can unlock a highly sophisticated performance channel for app marketing.

So, what is connected TV? Dig into our robust guide below to learn how CTV works, what factors are contributing to its rapid growth, and how growth marketers can leverage this performance channel to grow their apps. Uncover the huge marketing potential of CTV now.

Part 1: Connected TV explained

What is connected TV (CTV)?

The definition of CTV is any TV set or console connected to the internet, encompassing smart TVs, TV sticks, gaming consoles, and set-top boxes. CTVs are most commonly used to stream videos via downloaded apps using the content delivery method over-the-top (OTT), by which the content is delivered “over the top” of another platform.

What is connected TV advertising

Connected TV advertising is the term for video ads that are delivered to viewers over the internet while they stream. An example of this includes a viewer who receives an ad while watching YouTube or Netflix on their CTV device.

What is the difference between OTT and connected TV?

Let’s review CTV and OTT advertising. OTT is the method of delivering content over the internet, while CTV is the internet-enabled device users use to consume this content. For example, Netflix is an OTT platform that delivers content through your internet provider to the Netflix app on your smart TV, a connected TV device.

CTV vs. linear TV

Linear TV, often referred to as traditional TV, comprises satellite and cable television, and it differs from CTV in that it doesn’t deliver content via OTT but by (you guessed it) satellite or cable.

Additionally, the name “linear” delineates the order in which the content is delivered to the viewer—pre-determined by a programming schedule. In contrast, viewers utilizing CTV to stream do not have to adhere to a schedule but can simply choose to watch any of a platform’s available shows whenever they wish.

Part 2: CTV growth

The expanding CTV landscapeTV landscape

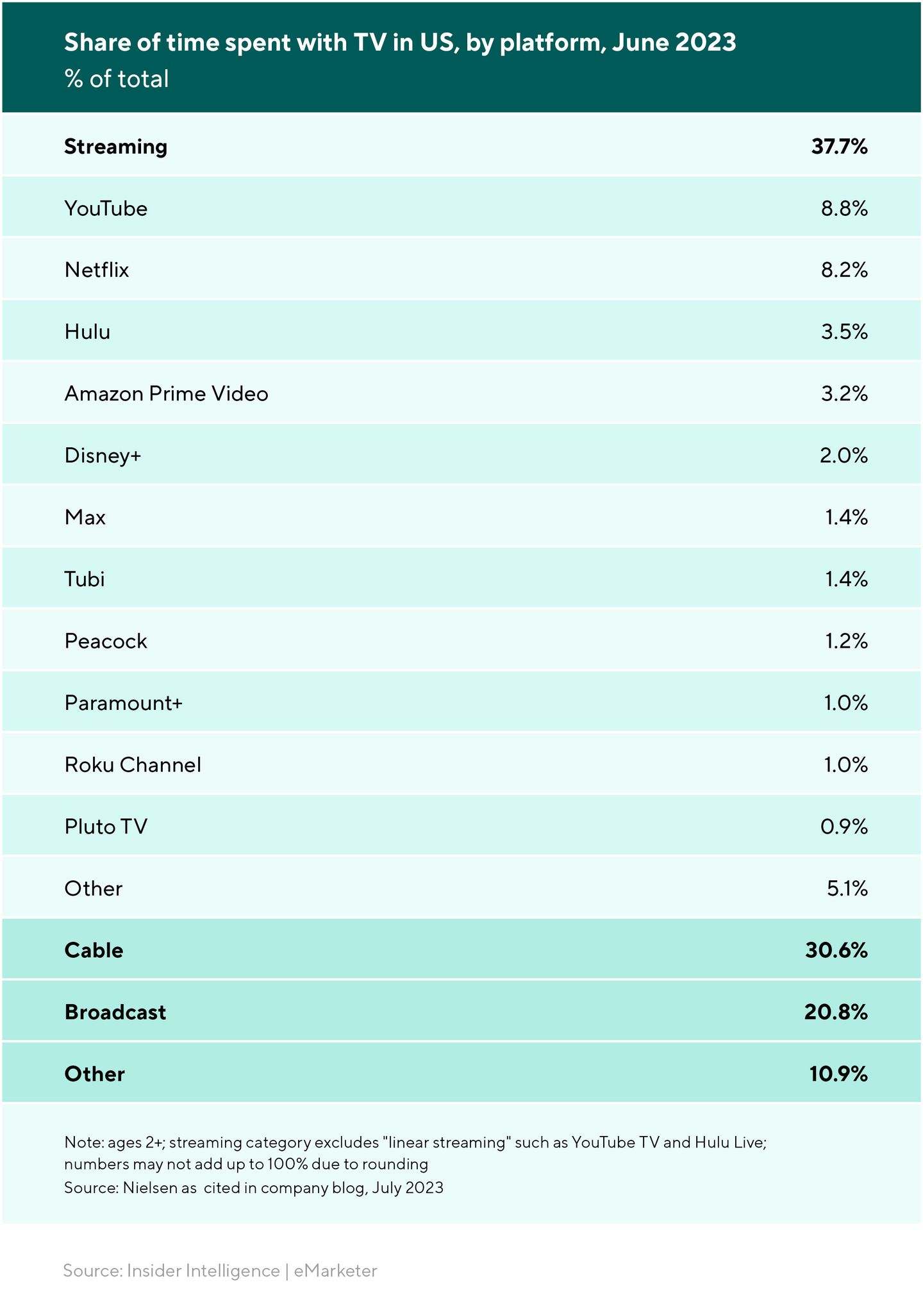

CTV’s rapid evolution has brought new possibilities to app marketers. More and more people consume video content on CTV devices and not via traditional cable TV. In 2022, streaming viewership overtook cable television for the first time in U.S. history and is projected to continue biting into cable TV viewership. By 2024, the ratio of connected TV households to traditional pay-TV households will be two to one.

As illustrated in the chart below, U.S. viewers spent 37.7% of their time streaming TV compared to 30.6% watching cable TV, and 20.8% viewing broadcast TV.

These 10 CTV statistics reveal tremendous growth opportunities for advertisers:

- There are over 1.1 billion CTV devices worldwide.

- 98% of internet-connected households are reachable via open programmatic CTV advertising.

- Two-thirds of the U.K. population watch digital videos on a CTV device.

- Nearly 69% of the U.S. population are CTV users.

- CTV adoption rates in Brazil and Mexico soar at 94% and 93%, respectively.

- By 2024, CTV advertising globally will hit US$29.6 billion.

- APAC saw a 15% year-on-year growth in CTV ad spend in Q1 2023.

- During CTV ads, viewers were engaged 71% of the time, 17% higher than linear TV.

- 86% of viewers are willing to watch ads on CTV if they are relevant to them.

- CTV earns an ROI 30% higher than other marketing channels.

Why is CTV growing at such a rapid pace?

Strictly speaking, streaming has been around for quite some time. (Remember the launch of Netflix’s streaming service back in 2007?) But streaming on CTV devices has seen explosive growth in the last few years, significantly furthering the connected TV market share. While the pandemic pushed more viewers to stream, we note the growth continues even post-pandemic and is likely due to the following reasons.

1. Connected TV devices are the new normal

Instead of replacing traditional TVs with another linear TV device, more users are turning to smart TVs and other streaming devices from major players like Apple TV, Roku, Amazon Fire TV, etc. For instance, the global smart TV market size was US$197.82 billion in 2022 and is predicted to rise at a CAGR of 11.4% between 2023 and 2030 to reach US$451.26 billion.

2. Rise of cord-cutters and cord-nevers

Related to the above, cord-cutters, those who have stopped paying for cable, and cord-nevers, the younger demographic who have never paid for cable TV, will surpass those that do pay for cable TV this year. Additionally, almost half of internet users no longer even watch linear TV. The main culprit for this? Streaming providers, which are cable TV’s stiffest competition. Users are opting for streaming services over cable in droves.

3. Content consumption flexibility

Users are now accustomed to streaming services, which allow them to determine which available show they wish to watch and when. They are no longer dependent on the schedule of broadcast TV to watch but can sit down at 2:00 AM, 1:00 PM, or any hour of the day to watch a show from an OTT’s inventory.

4. The entry of ad-tiers

Don’t be fooled; contrary to popular belief, consumers aren’t opposed to ads while streaming because this means they pay less for their streaming subscriptions. Ad-supported subscription services are relatively new to the connected TV market but are growing in popularity.

Netflix, Disney+, HBO Max, Hulu, and Paramount+ have all recently added ad-supported tiers to capture users who still want to stream but need to save costs. Streaming services win as well as they diversify their revenue streams, and even Apple is said to be developing a DSP that will launch ads on Apple TV+ in the near future.

Five months after launching its ad-supported tier, Netflix announced that over 25% of its new subscribers opt for ad-supported streaming and that this tier has also amassed more than five million subscribers.

Expanding beyond a Western context, video streaming services in South Korea and Japan, like Rakuten TV, have offered ad-supported streaming for some time. In fact, 71% of Japanese viewers watch ad-supported streaming services, proving the majority of the population has adopted ad-supported streaming.

What is AVOD? SVOD? FAST? Answer: Video monetization models

-

AVOD: Ad-supported video-on-demand. This is a subscription streaming model in which users pay a lower price than the regular subscription service because they’re watching video content with ads.

Example: Netflix’s Basic with Ads plan

-

SVOD: Subscription video-on-demand. This is a regular subscription streaming model in which users pay a certain fee to access ad-free content. Therefore, the price is higher than that of AVOD as it allows viewers to stream without ads, uninterrupted.

Example: Netflix’s standard plan

-

FAST: Free-ad supported streaming TV. This model lets viewers stream linear channels or on-demand content for free in exchange for watching ads throughout the content.

Example: The Roku Channel FAST service

5. Advertisers are flocking to CTV

With more users consuming more ad-supported streaming content, advertisers eye the potential of CTV. IAB projects a decrease of 6.3% in 2023 in linear TV spending as advertisers spend less on traditional TV advertising. Many of these advertisers are turning to CTV and in contrast to traditional TV, CTV advertising is expected to grow by 14.4%. Below, we’ll dig into the reasons advertisers are turning to CTV, further prompting CTV advertising growth.

Part 3: Why app marketers need to utilize CTV

The benefits of CTV advertising for app marketers

As mentioned above, more advertisers are turning to CTV as a performance channel, as half of marketers worldwide say that spending on CTV is effective. Here are several benefits of CTV advertising that app marketers should consider.

Gijsbert Pols, PhD

Director of Connected TV and New Channels, Adjust

Greater ad quality, engagement and recall

Studies show ad tolerance on CTV is much higher than on mobile. Why? Consider the viewing experience: CTV ads are typically watched on a bigger screen than smartphones, and the sound is on. Additionally, many CTV ads aren’t skippable. Studies reveal that these factors contribute to overall better ad quality, viewer engagement, and, consequently, greater ad recall. The image below shows that 46% of viewers recall CTV ads, versus 33% of social media ads, 12% of mobile gaming ads, and 9% of website ads.

Furthermore, brands that advertise on CTV are perceived by viewers as more relevant and innovative, improving brand image. Not bad, right?

Increased ad tolerance

Many people engage with their smartphones throughout the day as they multitask. However, when they sit down to consume content on a larger screen, they tend to be more relaxed and open to ads. Studies reveal that people have a much higher ad tolerance when they watch TV series, sports, and news (typically now on CTV devices) than when they play games, watch short-form videos, or listen to podcasts (usually on mobile devices). Therefore, your app’s ad will likely earn greater attention on CTV than the average mobile app ad.

Precise measurement and targeting

Unlike advertising on linear TV, in which ads are delivered to the masses, CTV offers advertisers more precise targeting capabilities.

On CTV, advertisers can target users in the following ways:

- Viewers who’ve made a previous purchase

- Contextual advertising

- Viewers who’ve visited a specific landing page

- Look-alike audiences

- Viewers of a specific intent, persona, location, and/or demographic

In addition to the above CTV targeting methods, advertisers can utilize first (when users have opted-in) and third-party data in their audience targeting to segment audiences further.

These targeting capabilities allow app marketers to display ads to their most niche and relevant audiences, reaching users that would have been unreachable otherwise and increasing the chance for conversion. Marketers can monitor CTV ad performance with detailed analytics that lets them accurately measure and prove the ROI of their CTV ads.

Cross-device campaigns

CTV devices are often linked to viewers’ mobile devices or computers, enabling app marketers to run cross-device campaigns. It’s crucial marketers pivot to a more holistic view of their marketing campaigns, with the mindset that mobile, CTV, PC, and console ads can all contribute to the success of each other’s efforts.

For example, did you know that 95% of consumers have their smartphones in their hands while watching TV? So, a user may initially see an ad for your mobile app on their CTV device and decide to install it. When they later download after seeing an ad on mobile or desktop served by Google Ads, Google Ads would receive the credit. However, the CTV ad had what we call “assisting” power in driving this install and ought to receive partial credit, informing future marketing strategies.

Marketers should know all the touchpoints that contribute to a conversion, which can be monitored by implementing measurement methods like view-through attribution. As CTV is an impressions-heavy channel, getting the full picture is essential to accurately evaluating campaign performance.

Part 4: CTV advertising and measurement

How does CTV advertising work?

Before app marketers foray into CTV advertising, it’s essential they understand the CTV ad buying process.

CTV ads are bought and sold in an auction via programmatic media buying in one of three ways:

- Open auction/Real-time bidding (RTB): Inventory prices are determined during a real-time auction.

- Private marketplace (PMP): This operates as an open auction but is invite-only.

- Programmatic direct: A publisher sells inventory directly to an advertiser at a fixed price, foregoing an auction.

Now, before we cover the buying process of CTV ad inventory, review the technological mediators that coordinate this process between an advertiser and a publisher.

The technological mediators for CTV ad buying

Demand-side platform (DSP): The software is for advertisers and allows media buyers to compete with one another, creating better deals for advertisers.

Supply-side platform (SSP): Uploads and connects inventory to multiple potential buyers/ad exchanges.

Ad exchange: Acts as the digital marketplace through which SSPs and DSPs are automatically matched. An auction occurs in milliseconds when several advertisers bid for the same category.

The six steps of the CTV ad-buying process

Below is the lightning-fast process by which CTV ads are sold.

- The viewer selects the content they wish to watch.

- The available information of the viewer is sent by the publisher to an ad exchange.

- The automated bidding process starts for this user.

- An SSP provides information such as content selection, age and location of the user, etc,

- DPSs with creative criteria matching the information of the SPP automatically place bids for the ad.

- The DSP with the highest bid is chosen, and the ad is placed.

Eight types of CTV ad types

Another exciting aspect of connected TV marketing is the different ad types available. Here are some common CTV ad formats. For the formatting guidelines of each ad type, see these IAB guidelines for CTV.

- Pre-roll ads: These ads play before the selected content starts and usually last between 15 and 30 seconds.

- Mid-roll ads: As the name suggests, these ads appear during a pause in the viewer’s content—between episodes or scenes.

- Post-roll ads: These ads are delivered after the content is over.

- Skippable ads: These ads play for a few seconds and then can be skipped by viewers.

- Pause ads: These ads are displayed when content is paused.

- Non-skippable ads: Viewers must complete these ads before they can watch their selected content.

- Interactive ads: Viewers are encouraged to engage with these ads through activities such as choosing the story path, playing a mini-game, or selecting shoppable content.

- Overlay ads: Often referred to as banner ads, overlay ads appear at the bottom of the screen as the content plays and can include text, interactive elements, or images.

Metrics used to measure CTV

There are several CTV metrics that app marketers can use to measure the performance of their CTV ads. From impressions to conversion rate, the following metrics can be used to assess the ROI, ROAS, engagement, reach, impact, and engagement of marketers’ CTV efforts.

Part 5: Start advertising on CTV

How to get started advertising on CTV

To begin advertising on CTV, it’s essential app marketers have the right CTV measurement tools, partners, and strategy in place.

1. Set up your strategy

Determine the purpose of your CTV campaigns by ascertaining the following:

- The audience you wish to reach

- The desired action for the audience to take

- The CTV metrics you’ll use

- The needed tools and partners

- The ad spend you can allocate to CTV campaigns

- The contribution of CTV campaign to your other marketing efforts

In identifying the above, you can then decide which advertising platform(s) you will partner with, the ads you will create, and the CTV measurement tools you will use.

During your research, check out our ebook on Mastering CTV. Inside you’ll access the latest trends and insights from the top CTV leaders in the industry.

2. Decide how to buy ad inventory

There are three main ways for advertisers to buy CTV ad inventory. What you decide will likely be dependent on your ad budget, the audiences you wish to reach, and your CTV know-how.

- Programmatic: DSPs and ad networks

Often, marketers new to CTV marketing tend to opt to buy via programmatic platforms as DSPs and ad networks typically require a lower spend and allow for a broader reach across different platforms.

- Platform direct: CTV ad platforms and AdTech companies

Marketers can also purchase ads directly from CTV platforms like Roku or Apple TV. However, as each platform or company has its own set of advertising rules, rates, and targeting capabilities, buying platform direct can be a bit daunting to navigate initially.

- Publisher direct: OTT video-streaming services

The last option is to buy ads directly from publishers like Netflix, YouTube, or Tubi. These OTT video streaming services offer greater control over ad placement and channels. However, note that your reach will be limited and buying ads publisher direct tends to be expensive.

Recommendation: Try Wurl to reach your audience of choice

Boasting the largest global marketplace for CTV, Wurl connects advertisers with some of the more famous media properties like BBC, Bloomberg, A&E Networks, and Roku, to name a few. But as Wurl offers reach across over 3K channels and 195 countries, marketers can also narrow down their audiences to find audiences most likely to engage with their brands.

3. Pick your CTV measurement solution

Selecting the right CTV measurement solution for your app marketing is crucial. Just as you wouldn’t trust a self-attributing network’s (SAN) reporting to be completely accurate and unbiased regarding mobile attribution, don’t rely on CTV platforms or streaming services for your CTV measurement needs. We’ve curated a checklist below to help you ensure you have what you need to monitor and act on your CTV campaigns.

Your CTV measurement solution should allow you to:

- Measure CTV campaign influence on mobile apps.

- Get a comprehensive view of CTV ad performance: reach, frequency, engagement.

- Create and track QR codes for CTV campaigns.

- Access top partner integrations.

- Analyze the impact of CTV campaigns on other marketing channels.*

*Currently, only available with Adjust’s CTV AdVision.

Bottom line: Your CTV measurement solution should allow you to prove ROI on your CTV campaigns.

Why Adjust’s CTV AdVision is app marketers’ top choice

Here are four strong reasons why CTV AdVision is the best CTV measurement solution for app marketers.

- First to market

As we move into the era of cross-device marketing, more app marketers are considering new channels such as CTV or PC and console to reach potential users. At Adjust, we’ve been anticipating this change, which is why in 2022, we put out the first comprehensive CTV measurement solution on the market—CTV AdVision.

- Award-winning CTV solution

By the end of 2022, CTV AdVision won the 2022 Cynopsis Model D Awards for the Best New Measurement Tool in 2022. Its popularity among our clients continues to grow as they gain confidence in acting on the insights CTV AdVision provides.

- Comprehensive marketing overview

CTV AdVision allows marketers to master all the above functions, such as measuring CTV to Mobile installs and CTV to CTV installs. An important differentiator? CTV AdVision is currently the only CTV measurement solution on the market that lets you see the impact of CTV campaigns on your other marketing channels. This is crucial if you wish to have a holistic view of your marketing efforts.

For example, perhaps a user watched your ad on Hulu on a CTV device before they converted via Google Ads. CTV AdVision would provide an “assist” credit to Hulu so you could know that your ads on Hulu are influencing conversion.

- Leading partner integrations

Adjust offers premium partner integrations allowing our clients to measure CTV campaigns running on YouTube, Google Marketing Platform, Amazon Fire TV, and Apple TV, to name a few. From DSPs to agencies to CTV apps and more, we offer a robust network of partners and integrations to ensure our clients have access to the top channels they wish to pursue. After all, your MMP’s CTV solution is only as strong as its partner coverage.

Check out our documentation for CTV apps and CTV to mobile to browse the many integrations and partnerships available to our clients.

Jasmine Cao

Sr. Growth Manager, AppLovin

4. Test and grow

While linear TV is slow in terms of measurement, marketers can optimize their CTV campaigns quickly and make informed decisions using real-time data. As marketers can now prove ROI on their CTV campaigns, they have the possibility of seeing which ads, channels, and campaigns are performing the best to scale or pause budgets accordingly. Consider the following areas to test:

Try different creatives

In the article Marketers’ top 10 burning CTV questions (answered), Marta Masachs, Head of Growth at FunPlus, suggests marketers new to CTV start testing creatives that have been successful in their other user acquisition channels. She recommends creating a 30-second and 15-second version of your CTV ad to see which works best. Ultimately, users should remember the ad beyond its initial viewing and want to search for it afterward. For example, see this well-executed, 30-second ad by Wordscapes.

Utilize generative AI

Generative AI is already a tool marketers can employ in creating and running CTV campaigns. The technology can be leveraged to automate creative reviews, to create a dynamic ad workflow, and to develop CTV-ready ads with mere text inputs. M-commerce apps may perk up upon learning that the video commerce company Firework is exploring generative AI to drive user engagement and conversions after a livestream ends for an “always on” shopping experience.

Increase visibility with view-through attribution

As mentioned, CTV digital marketing ads have higher ad tolerance and visibility than ads viewed on mobile devices. However, many marketers forgo CTV advertising because of its lower click rates. However, using the view-through attribution method, also known as impression tracking, marketers can access more accurate performance measurement of their CTV ad campaigns and identify the uplift on their other channels.

For more insights on the benefits of VTA for mobile marketers, check out our view-through attribution ebook.

Conclusion

Users, attribution, and advertising trends are moving toward a cross-device ecosystem. App marketers running ads on mobile devices alone are missing out on the performance channel where users continue to spend more time and attention—CTV.

As more players enter the market, more content is available to viewers, providing greater inventory for advertisers. This expansion in inventory is a major plus for app marketers as they can better reach niche audiences to serve them customized, segment-specific advertisements via a mix of targeting options.

With the most comprehensive CTV measurement solution for app marketers on the market, and the largest CTV partnership network, Adjust is the mobile measurement suite for the ROI and data-driven marketer. To see CTV AdVision in action and watch firsthand how Adjust can provide a comprehensive overview that drives results across platforms and channels, request your demo now.

Want to get the latest from Adjust?